Frac Sand Supply Chain

Wisconsin frac sand mine

FRACTRACKER

Fracking of gas and oil requires forcing open rock, usually with an initial round of explosives followed by high pressure pumping of a toxic cocktail of water, chemicals, and suspended grains of sand. Massive quantities—up to 25,000 tons per well—of this frac sand prop open the blasted and pressurized fissures in the rock.

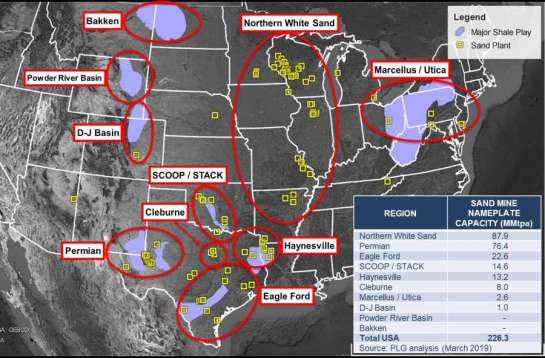

Until 2018, midwestern US mines thoroughly dominated the frac sand supply. Since mid 2017, perhaps two dozen mines have opened in the Permian Basin region, in a scramble by the increasingly debt-ridden shale industry to cut costs with inferior but cheaper sand. These mines may supply two third of US frac sand demand by the end of 20191.

Besides enabling dirty fossil fuel extraction by supplying a crucial input, sand mines are destructive, water-polluting, and energy-hungry in and of themselves. The required steps2:

- Kill and clear trees, shrubs, and all other vegetation

- Dig out topsoil, killing the microbial communities on whom fertility depends

- Remove unwanted rock layers

- Blast, dig out and crush the sandstone

- Transport by truck or conveyor belt to an on-site or remote processing plant

- Wash, dry, screen, and sort sand

- Transport sand by rail and/or truck

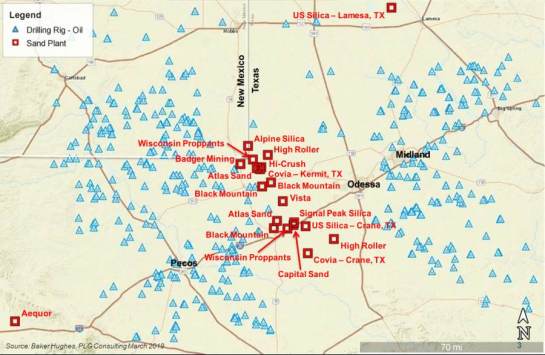

Rail and truck transport are vulnerable: railways have been disrupted by blockades and with jumper cables, though single incidents don’t have broad or long-lasting results. Truck transport, being decentralized, is normally difficult to impact. However, in 2019, industry analysts expect nearly 6,000 round-trip truckloads of sand per day to be delivered from a concentrated set of Permian sand mines between the Midland and Delaware basins. Highways in the vicinity of the mine cluster become potential bottlenecks.

Frac sand supply is perhaps most vulnerable in the stages dependent on electricity, including during conveyor transport, at processing plants, and during loading and unloading of railcars and trucks. When the electrons stop flowing, so does the sand. The industry is increasingly moving to assembly-line operations, which improves efficiency when everything works as planned, but otherwise can easily break down into cascading failure. When frac sites depend on just-in-time sand delivery, extraordinary delays may impose disproportionate costs. RBN Energy explains3:

Hydraulic fracturing of a typical Permian well with a 10,000-foot lateral requires about 12,500 tons of frac sand—enough sand to fill more than 500 large sand trucks. That sand needs to be at the ready—delivered, offloaded, stored, and set for blending and use. If it’s not, the well completion and the start of production would be delayed or the hydraulic fracturing process would be shut down after starting—a mortal sin in the shale world.

Managing a steady flow of frac-sand deliveries to multiple well sites in the Permian and the other shale plays is akin to air traffic control […] The goals are to minimize both driving time and waiting time—either at the sand mine (when picking up sand) or at the lease, where long queues can leave drivers waiting for hours if the pace of deliveries is not properly managed.

Problems at centralized loading sites might impact multiple frac sites. For example, at the Black Mountain Sand mine4:

It takes an army of trucks to haul that much sand to well sites. And they need to get in and out of the mines efficiently. An automated system that knows which sand to feed each truck speeds the process along. Still, they come in so fast that the line can back up quickly. On a recent afternoon, it was several deep. On a really hectic day, it can swell to 100.5

An activist blockade, an electrical outage, disruptions to loading equipment, or hardware or software damage to the automated system would make the loading process much less efficient—or perhaps shut it down entirely.

Big picture

As of early 2019, sand mining is in a bust phase6 of the typical boom/bust commodity cycle. Multiple mines have been idled.7 Disruption to supply from one mine or processing plant is fairly easily replaced from others; if activist intervention forced a mine or plant to shut down, idled sites could restart to meet the demand. Targeting mines, plants, or decentralized transport would be attacks of attrition, unlikely to have systemic impact.

In contrast, truck loading sites are transportation bottlenecks before the final journey to dispersed drill sites. Breakdown in these hubs would delay critical supply of sand to multiple frac operations at once, so would more likely trigger cascading failure.

-

“The Frac Sand Revolution” part 4, April 16, 2019 ↩︎

-

Frac Sand Load-in Proccess at Black Mountain Sand ↩︎

-

“Worthless Just Two Years Ago, West Texas Sand Now Brings in Billions”, July 10, 2018 ↩︎

-

“Texas-Size Glut of Frack Sand Means 19% Drop in Prices”, February 6, 2019 ↩︎

-

“As pipeline shortage slows Permian output, sand miners take hit”, September 27, 2018 ↩︎

Consider supporting our work by joining our mailing list below, sharing & "liking" this page, and following us on social media. You may freely republish this Creative Commons licensed article with attribution and a link to the original.